Securing a private student loan without cosigner is a significant hurdle for many international students pursuing higher education in the US or Canada. The lack of a US or Canadian credit history and navigating unfamiliar financial systems often leads to loan applications being denied. This guide addresses the challenges international students face and provides practical steps to increase their chances of obtaining the necessary funding for their studies.

Toc

- 1. Understanding the Challenges for International Students

- 2. Navigating Private Student Loans Without a Cosigner

- 3. Related articles 01:

- 4. Key Lenders for International Students

- 5. Recent Developments in International Student Lending

- 6. Alternative Financing Options for International Students

- 7. Related articles 02:

- 8. Building Credit While Studying Abroad

- 9. Addressing Common Concerns and Misconceptions

- 10. Conclusion

Understanding the Challenges for International Students

International students encounter several unique obstacles when seeking a private student loan without a cosigner.

Credit History Gaps

One of the primary challenges is the absence of a credit history in the US or Canada. Lenders typically assess applicants based on their creditworthiness, which can be a significant barrier for students who have recently relocated. A weak credit profile often necessitates a cosigner for loan approval, further complicating the process.

Immigration Status Impact

Additionally, immigration status plays a crucial role in the loan application process. Lenders closely scrutinize the type of visa held and the anticipated duration of stay, which can significantly influence their willingness to extend credit. Many international students struggle to provide proof of income, as they often have limited earnings while studying.

Documentation Hurdles

The requirements for documentation can also be daunting. Students must navigate the complexities of demonstrating their financial stability through documents from their home countries, which may not align with the expectations of US or Canadian lenders. Language barriers can further complicate interactions with lenders, highlighting the importance of seeking assistance when necessary.

Fluctuating Exchange Rates

Another financial challenge that is often overlooked is the impact of fluctuating exchange rates. International students may find it difficult to secure loans and manage repayments due to currency fluctuations, which can affect their financial planning and overall ability to afford education costs. This uncertainty adds an additional layer of stress for students already facing various financial hurdles.

Understanding lender requirements is vital when exploring options for a private student loan without cosigner.

Shifting Lender Criteria

Different lenders have distinct criteria; however, many are now looking beyond credit history to factors such as academic performance and future career potential. This shift can benefit students who excel academically but may lack an established credit profile.

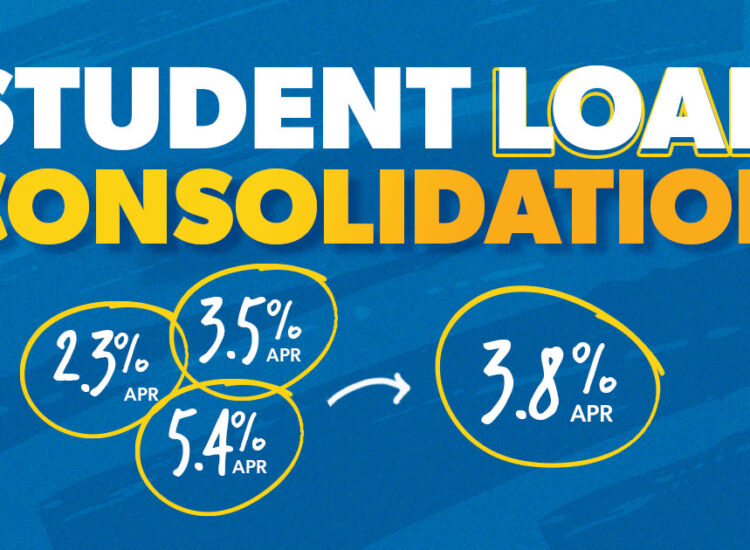

Interest Rates and Overall Costs

It’s important to note that loans without a cosigner typically come with higher interest rates. Lenders perceive these loans as riskier, leading to less favorable terms. However, while rates might be higher, some lenders offer competitive rates based on other factors, which can result in comparable overall costs to loans with cosigners. Students should be prepared for the possibility of securing smaller loan amounts at elevated interest rates, making it essential to assess their financial needs carefully.

Comprehensive Loan Comparison

Beyond just interest rates, it’s crucial to compare loan terms holistically. Factors such as origination fees, prepayment penalties, and grace periods should also be considered, as they can significantly impact the overall cost of the loan. Understanding these nuances allows students to make informed decisions that align with their long-term financial goals.

Repayment Plans

Repayment plans also warrant careful consideration. Many lenders provide flexible repayment options, including income-driven plans that adjust payments based on the borrower’s financial situation. Familiarizing oneself with these alternatives can help students select a loan that is manageable in the long run.

Loan Disbursement Process

Moreover, understanding the loan disbursement process is critical. Funds from private loans typically go directly to the educational institution, covering tuition and associated expenses. Knowing how this process works is essential for international students, as it directly impacts their budgeting and financial planning.

1. https://sachico101.com/mmoga-bhg-loan-reviews-a-small-business-owners-guide/

2. https://sachico101.com/mmoga-your-guide-to-sofi-home-equity-loans-for-home-improvements/

3. https://sachico101.com/mmoga-penfed-mortgage-loan-a-complete-guide-for-homebuyers/

4. https://sachico101.com/mmoga-bank-statement-mortgage-loans-a-freelancers-guide-to-homeownership/

5. https://sachico101.com/mmoga-what-is-a-good-student-loan-interest-rate-in-2024/

Key Lenders for International Students

Several lenders specialize in providing no cosigner student loans for international students, each offering options tailored for those without a cosigner.

Ascent Student Loans

Ascent student loans stands out as a leading lender in this arena, offering loans specifically designed for international students. Their outcomes-based loan option allows students with limited or no credit history to qualify based on academic performance and future earning potential. This feature is particularly beneficial for undergraduate students lacking a cosigner. However, eligibility criteria and loan terms can change, so it’s crucial for students to check the lender’s website for the most up-to-date information.

Edly Student Loans

Another notable option is Edly student loans, which offers innovative solutions for international students. A standout feature of Edly is its income-driven repayment plan, allowing borrowers to make payments based on their income levels. This safety net can be invaluable during times of financial uncertainty. Like Ascent, Edly also has specific requirements, including proof of academic performance. Students should verify the latest terms on Edly’s website to ensure they have the most accurate information.

A.M. Money and Other Lenders

In addition to Ascent and Edly, other lenders may provide private student loans without cosigner options to international students. A.M. Money is worth considering as they offer specialized products aimed at this demographic. Researching various lenders and comparing their offerings can help students find the best fit for their financial needs.

Recent Developments in International Student Lending

The landscape of student lending is evolving, with several recent trends that are shaping the options available to international students.

Alternative Credit Scoring Models

Some lenders are increasingly utilizing alternative credit scoring models, which consider factors beyond traditional credit history. For example, lenders like LendKey and Upstart are employing non-traditional data points such as educational background, job history, and even cash flow analysis to assess creditworthiness. This trend opens doors for international students who may lack a conventional credit history.

Growing Availability of Income-Share Agreements

Another innovative option gaining traction is the income-share agreement (ISA). This model allows students to receive funding in exchange for a percentage of their future income for a set period. Companies like Pave and Cofunder are at the forefront of this approach, offering a unique financing alternative that may be more accessible for students without cosigners.

Alternative Financing Options for International Students

If securing a private student loan without cosigner proves challenging, international students can explore alternative financing options.

Scholarships and Grants

Scholarships and grants are invaluable resources for funding education. Many organizations and institutions offer financial aid specifically for international students. Researching these opportunities and applying early can significantly reduce the financial burden of education. However, it’s important to acknowledge that scholarships and grants are often highly competitive and may not cover the full cost of education.

Part-time Employment

While studying, many international students seek part-time employment to help cover living expenses. However, legal limitations on work hours and the types of jobs available can pose challenges. Understanding visa regulations and finding suitable job opportunities can help students balance work and study effectively.

Family Support

Family support can play a crucial role in financing education abroad. International students may rely on financial assistance from family members, which can alleviate some of the financial stress associated with tuition and living expenses.

Educational Institutions’ Financial Aid

Many educational institutions offer financial aid packages for international students. Exploring the financial aid options available through the institution is essential, as they may provide scholarships, grants, or work-study opportunities that can ease the financial burden.

1. https://sachico101.com/mmoga-penfed-mortgage-loan-a-complete-guide-for-homebuyers/

2. https://sachico101.com/mmoga-your-guide-to-sofi-home-equity-loans-for-home-improvements/

3. https://sachico101.com/mmoga-what-is-a-good-student-loan-interest-rate-in-2024/

4. https://sachico101.com/mmoga-bank-statement-mortgage-loans-a-freelancers-guide-to-homeownership/

5. https://sachico101.com/mmoga-bhg-loan-reviews-a-small-business-owners-guide/

Building Credit While Studying Abroad

Establishing a credit history is vital for international students who wish to secure loans without a cosigner. Here are some strategies to consider:

Credit Builder Loans

Credit builder loans are designed to help individuals establish or improve their credit scores. By making regular payments, borrowers can create a positive credit history, which can be beneficial when applying for loans in the future.

Secured Credit Cards

Secured credit cards require a deposit that serves as the credit limit. By using a secured card responsibly, students can build credit while managing their spending. This option is particularly useful for those who may not qualify for traditional credit cards.

Becoming an Authorized User

Another effective method for building credit is becoming an authorized user on a family member’s credit card. This arrangement allows students to benefit from the cardholder’s positive credit history, potentially boosting their own credit score.

Monitoring Credit Reports

Regularly monitoring credit reports is essential for identifying errors and understanding one’s credit standing. Students should take advantage of free credit report resources to ensure their credit history is accurate.

Addressing Common Concerns and Misconceptions

Many international students turn to online forums, such as Private student loan without cosigner reddit, to seek advice and share experiences about securing private student loans without a cosigner.

Loan Eligibility

Discussions often revolve around the challenges of obtaining a private student loan without cosigner—particularly for those with no credit history or poor credit. Students frequently seek advice on improving their creditworthiness and share strategies that have worked for them.

Misconceptions about No-Cosigner Loans

There are several misconceptions about obtaining loans without a cosigner. Some believe that it is impossible to secure funding without one, while others may not be aware of the various lenders that offer no cosigner loans. Engaging with online communities can provide valuable insights and clarify misunderstandings.

Strategies for Success

Sharing successful strategies from online forums and personal experiences can empower students to navigate the loan process more effectively. Tips from peers who have successfully secured funding can offer encouragement and practical advice.

Conclusion

Securing a private student loan without a cosigner as an international student presents unique challenges, but it’s achievable with careful planning and research. By understanding lender requirements, exploring alternative financing options, and strategically building credit, international students can significantly improve their chances of funding their education. Remember to compare offers from lenders like Ascent student loans , Edly student loans , and A.M. Money, while also considering scholarships, grants, and part-time employment opportunities. Stay informed about current trends in the lending landscape, such as alternative credit scoring models and income-share agreements, to explore all available options. Start your research today and take control of your financial future.