Securing a home loan can be a daunting task, particularly with the ever-changing landscape of interest rates. A PenFed mortgage loan presents a viable option for many homebuyers. However, understanding its intricacies is essential to making informed decisions. This guide will not only explore PenFed’s offerings but will also compare them with those of Navy Federal Credit Union, providing a comprehensive overview of rates, requirements, and customer experiences.

Toc

- 1. Understanding PenFed Mortgage Loan Rates

- 2. PenFed Mortgage Loan Requirements and Eligibility

- 3. Types of Mortgages Offered by PenFed

- 4. Related articles 01:

- 5. The PenFed Mortgage Application Process: A Step-by-Step Guide

- 6. PenFed Mortgage Loan Payment and Management

- 7. Related articles 02:

- 8. Comparing PenFed and Navy Federal Mortgages: Which is Right for You?

- 9. Conclusion

Understanding PenFed Mortgage Loan Rates

When considering a PenFed mortgage loan, it’s vital to understand the various factors that influence mortgage interest rates. PenFed is recognized for its competitive rates, which can fluctuate based on multiple criteria, including credit scores and down payment amounts. Borrowers with excellent credit can often secure rates that are below the national average, making PenFed an attractive option.

Key Factors Affecting PenFed Mortgage Loan Interest Rates

- Credit Score: One of the primary determinants of your PenFed mortgage loan rates is your credit score. A higher score typically results in lower interest rates, significantly impacting your overall loan costs. For instance, a borrower with a 760 credit score might receive a rate 0.5% lower than someone with a 700 score.

- Down Payment Size: The amount you can put down upfront also plays a crucial role. A larger down payment often translates to better rates, which can save you a substantial amount over the life of the loan. For example, a 20% down payment could result in a 0.25% reduction compared to a 5% down payment. These differences, while seemingly minor, can accumulate to significant savings over a 30-year mortgage.

- Economic Conditions: Broader economic factors, such as inflation and Federal Reserve policies, can also impact PenFed mortgage loan interest rates. Staying informed about these trends can help you time your application strategically. For instance, the Federal Reserve’s series of interest rate increases in 2022 directly impacted mortgage rates, causing them to rise significantly.

- Comparative Rates: Evaluating PenFed’s rates against those offered by Navy Federal and the national average provides valuable insights. Regularly checking PenFed’s website for current rates is advisable, as they can fluctuate frequently.

PenFed Mortgage Loan Requirements and Eligibility

Understanding the eligibility criteria is crucial before applying for a PenFed mortgage loan. This section will detail the requirements and compare them with those set by Navy Federal.

Minimum Credit Score Requirements

For conventional loans, PenFed generally requires a minimum credit score of 620. However, certain loan types, such as VA loans, may have different standards. While these requirements are standard, it’s important to note that some lenders, particularly smaller regional banks or credit unions, might offer more lenient credit score requirements. Borrowers with strong compensating factors, such as a high down payment or stable employment history, may find better options elsewhere. It’s always advisable to shop around and compare offers from multiple lenders.

Debt-to-Income Ratio Expectations

Your debt-to-income (DTI) ratio is another critical factor in securing a PenFed mortgage loan. A lower DTI ratio indicates a better ability to manage monthly payments, enhancing your chances of approval. Most lenders, including PenFed, prefer a DTI ratio of 43% or lower.

Required Documentation

Preparing the necessary documentation is essential for a smooth application process. Commonly required documents include:

- Proof of income (such as pay stubs and tax returns)

- Employment verification

- Credit report authorization

- Bank statements

- Identification

Military Personnel and Veterans

Both PenFed and Navy Federal offer favorable mortgage conditions for military personnel and veterans. However, the specific eligibility criteria may differ, particularly regarding down payment expectations and credit benchmarks.

Pre-Qualification vs. Pre-Approval

Before diving into the application process, it’s essential to understand the difference between pre-qualification and pre-approval. Pre-qualification offers a rough estimate of how much you can borrow, while pre-approval involves a more in-depth assessment of your finances, providing a clearer picture of your borrowing capacity.

Types of Mortgages Offered by PenFed

PenFed offers a wide range of mortgage options designed to meet diverse financial needs. Each mortgage type comes with its own set of benefits and potential drawbacks, allowing borrowers to find the solution that best aligns with their goals. Here’s a closer look at the various options available:

Fixed-Rate Mortgages

Fixed-rate mortgages provide long-term stability with a consistent interest rate and monthly payment throughout the life of the loan. This predictability makes them an excellent choice for buyers who plan to stay in their homes for many years, as it eliminates the risk of sudden payment increases. PenFed offers both 15-year and 30-year fixed-rate options. A 15-year term typically comes with lower interest rates and allows you to pay off your loan faster, though monthly payments may be higher. In contrast, the 30-year option spreads payments over a longer period, resulting in lower monthly costs but more interest paid over time.

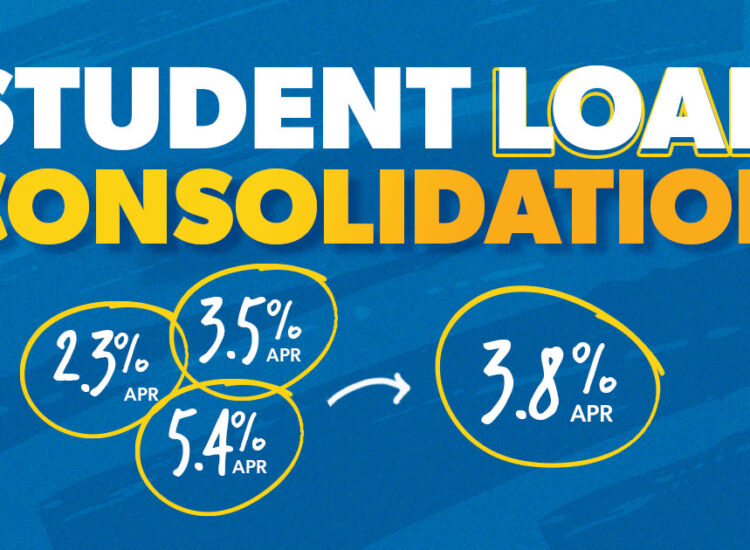

1. https://sachico101.com/mmoga-what-is-a-good-student-loan-interest-rate-in-2024/

2. https://sachico101.com/mmoga-your-guide-to-sofi-home-equity-loans-for-home-improvements/

4. https://sachico101.com/mmoga-bank-statement-mortgage-loans-a-freelancers-guide-to-homeownership/

5. https://sachico101.com/mmoga-bhg-loan-reviews-a-small-business-owners-guide/

Adjustable-Rate Mortgages (ARMs)

Adjustable-rate mortgages, or ARMs, can be a smart choice for buyers who plan to own their home for a shorter duration or want lower initial costs. These loans start with an introductory period of fixed interest rates, often lower than fixed-rate mortgages, which can lead to significant short-term savings. After the fixed period ends, the rate adjusts based on market conditions, which could lead to increases or decreases in monthly payments. PenFed offers options like the 5/6 ARM and 7/1 ARM, where the first number indicates the initial fixed-rate period in years, and the second shows how often rates adjust afterward. While ARMs can save money upfront, borrowers should carefully consider the potential for higher payments later in the loan term.

VA Loans

VA loans are a specialized option designed for veterans, active military service members, and eligible surviving spouses. These loans often require no down payment, making homeownership more accessible. They also come with competitive interest rates, no private mortgage insurance (PMI) requirements, and more lenient credit qualification standards compared to conventional loans. VA loans are backed by the U.S. Department of Veterans Affairs, ensuring added benefits for those who have served the country. However, they are only available to those who meet specific eligibility criteria, and borrowers may need to pay a funding fee, depending on the loan terms and down payment amount.

FHA Loans

FHA loans, backed by the Federal Housing Administration, are designed to help first-time homebuyers or those with lower credit scores achieve homeownership. They allow for smaller down payments, sometimes as low as 3.5% of the home’s price, which can make buying a home more achievable for people without significant savings. However, FHA loans come with a requirement for mortgage insurance, which includes both an upfront premium and ongoing monthly payments. This added cost can increase the overall expense of the loan, so it’s essential to weigh the benefits of lower upfront costs against long-term affordability.

Jumbo Loans

Jumbo loans are specifically for high-value properties that exceed the conforming loan limits set by the Federal Housing Finance Agency (FHFA). These loans are ideal for buyers purchasing luxury homes or properties in high-cost areas. Because they fall outside conventional loan limits, they often come with higher interest rates, larger down payment requirements, and stricter credit score qualifications. While jumbo loans allow borrowers to finance homes that might not be covered by traditional mortgages, the higher financial demands make them better suited for individuals with strong credit and significant savings.

Understanding the pros and cons of each mortgage type is key to making an informed decision. Whether you’re a first-time buyer, a veteran, or someone looking to invest in a high-value property, PenFed offers a solution tailored to your unique financial situation. Take the time to evaluate your long-term plans, budget, and eligibility to find the mortgage option that aligns perfectly with your needs.

The PenFed Mortgage Application Process: A Step-by-Step Guide

Applying for a PenFed mortgage loan is a straightforward and user-friendly process, especially with the convenience of online applications. Whether you’re a first-time homebuyer or looking to refinance, PenFed aims to make the journey as smooth as possible. Here’s a detailed step-by-step guide to help you navigate the process effectively.

Steps in the Online Application Process

- Start Your Application: Begin by visiting the PenFed website and navigating to the mortgage section. Select the type of mortgage loan that meets your needs—whether it’s for a new home purchase or refinancing an existing loan—and click on “Apply Now” to start.

- Prepare Required Documents: Gather all necessary documentation, such as proof of income, tax returns, bank statements, and identification. These documents ensure you can complete your application without interruptions and provide lenders with the information they need to assess your eligibility.

- Complete the Application Form: Carefully fill out the online application form, providing accurate details about your financial history, employment status, and the property you’re interested in. Double-check your entries before submitting to avoid errors that could delay processing.

- Track Your Application: Once submitted, you can use the online platform to monitor the progress of your application in real-time. This feature helps you stay informed about any updates, requests for additional documents, or next steps in the process.

- Communicate with Loan Officers: PenFed provides access to experienced loan officers who are there to guide you through the process. Don’t hesitate to reach out if you have any questions, need clarification, or require assistance with your application.

Importance of Document Readiness

Being well-prepared with the right documents can significantly expedite the mortgage application process. Missing or incomplete paperwork can lead to delays, so it’s a good idea to create a checklist of required items before starting your application. This preparation helps ensure a smoother experience and lets you focus on the excitement of securing your new home.

PenFed Mortgage Loan Payment and Management

Once your PenFed mortgage loan is approved, the next step is managing your payments effectively to maintain a good standing with your lender. PenFed offers several convenient payment options to fit your lifestyle, making it easy to stay on top of your financial obligations.

Available Payment Methods

- Online Payments: PenFed’s secure website allows you to make one-time or recurring payments with ease. Log in to your account, choose the payment amount and date, and submit your payment in just a few clicks.

- Automatic Withdrawals: Simplify your life by setting up automatic payments directly from your bank account. This ensures your payments are made on time every month without the need for manual intervention.

- Traditional Mail: For those who prefer conventional methods, PenFed still accepts payments by mail. Simply send your check along with the required payment slip to the designated address provided by the lender.

Timely Payments Matter

Making on-time payments is crucial for maintaining a strong credit score and avoiding costly late fees or penalties. Late or missed payments can negatively affect your financial health and creditworthiness. To avoid these risks, consider setting up automatic withdrawals or using reminders through the online portal.

Additional Tools for Payment Management

PenFed also provides resources and tools to help you keep track of your mortgage payments. Through your online account, you can view your payment history, download statements, and even explore options for paying off your loan faster by making extra payments toward the principal.

By staying organized and leveraging PenFed’s flexible payment options, you can manage your mortgage with confidence and focus on enjoying your new home.

Customer experiences with PenFed mortgage loans vary widely, offering a mix of positive and negative feedback that can provide valuable insights for prospective borrowers. Taking the time to understand these reviews can help borrowers better gauge what to expect when working with PenFed.

Positive Aspects

Many customers praise the efficiency of PenFed’s online application process, which allows borrowers to apply for mortgages from the comfort of their homes. The streamlined process is particularly appealing to tech-savvy individuals looking for a hassle-free experience. Additionally, PenFed is known for offering competitive rates that can save borrowers money over the life of their loan. For many, these aspects make PenFed an attractive option for securing a mortgage.

2. https://sachico101.com/mmoga-what-is-a-good-student-loan-interest-rate-in-2024/

3. https://sachico101.com/mmoga-bank-statement-mortgage-loans-a-freelancers-guide-to-homeownership/

4. https://sachico101.com/mmoga-your-guide-to-sofi-home-equity-loans-for-home-improvements/

5. https://sachico101.com/mmoga-bhg-loan-reviews-a-small-business-owners-guide/

Common Concerns

On the flip side, some borrowers have reported challenges during the approval process, citing issues with communication and delays in receiving updates. Concerns about customer service responsiveness have been prevalent in reviews, with some borrowers feeling frustrated by a lack of timely answers to their questions. These issues have led to dissatisfaction for some customers, particularly those navigating the mortgage process for the first time.

Addressing Customer Feedback

In response to this feedback, PenFed is actively taking steps to improve the overall customer experience. The company has been focusing on enhancing its online resources, including FAQs and support documentation, to make the process clearer and easier to navigate. Additionally, PenFed is working to streamline the application and approval processes further, while also investing in improving customer service responsiveness. By addressing these concerns, PenFed aims to build stronger relationships with its borrowers and provide a more reliable and satisfying experience.

Prospective borrowers are encouraged to weigh the positive aspects against potential challenges to determine if PenFed is the right fit for their mortgage needs.

Comparing PenFed and Navy Federal Mortgages: Which is Right for You?

Both PenFed and Navy Federal Credit Union offer a wide range of mortgage options, making them popular choices for borrowers. However, there are some key differences between the two that can help you decide which is the right fit for your specific needs.

Eligibility Criteria

PenFed membership is open to all branches of the military, government employees, and their families, as well as certain employer groups and associations. On the other hand, Navy Federal requires membership in the armed forces or Department of Defense-related employment to qualify for their mortgage products.

Mortgage Rates and Fees

While both institutions offer competitive rates, PenFed tends to have slightly lower fees compared to Navy Federal. Additionally, PenFed offers a wider range of mortgage products, including jumbo loans and adjustable-rate mortgages, while Navy Federal primarily focuses on conventional fixed-rate mortgages.

Final Decision

Ultimately, the best option for you will depend on your individual situation and preferences. It’s essential to carefully compare rates, fees, and eligibility criteria between the two before making a decision. Consider also reaching out to a loan officer at each institution for personalized guidance based on your specific needs. Whichever you choose, both PenFed and Navy Federal have strong reputations for providing reliable and competitive mortgage options for their members.

To aid potential borrowers in making informed decisions, a side-by-side comparison of PenFed and Navy Federal mortgages can highlight the strengths and weaknesses of each lender.

Choosing the Best Fit

Determining whether PenFed or Navy Federal is the better option largely depends on your individual circumstances, including eligibility and specific loan needs. Evaluating both lenders can lead to a more informed choice that aligns with your homeownership goals. Ultimately, both lenders offer competitive rates and a variety of mortgage options to help you secure your dream home. So, it’s important to carefully consider your financial situation and compare the details of each lender before making a final decision.

Conclusion

This guide provided a comprehensive overview of PenFed mortgage loans, covering everything from interest rates and requirements to the application process and customer experiences. By comparing PenFed with Navy Federal and understanding the different mortgage types available, you are now better equipped to make an informed decision about your home financing. Remember to utilize the resources mentioned, such as the PenFed mortgage calculator and the PenFed mortgage phone number, to further personalize your research and find the perfect mortgage solution for your needs. Start your homeownership journey today by exploring PenFed’s options.