Many homeowners may think of home equity loans as a means for funding large-scale renovations, but a SoFi home equity loan can serve a variety of financial needs. Whether you’re looking to embark on smaller renovation projects, consolidate debt, or manage unexpected expenses, a SoFi home equity loan offers flexibility. However, keep in mind that the process includes credit checks and home appraisals, which can delay access to your funds. This article will provide a comprehensive overview of SoFi home equity loans, their practical applications, and important considerations to keep in mind.

Toc

- 1. Understanding SoFi Home Equity Loan Options for Home Renovations

- 2. Related articles 01:

- 3. SoFi Home Equity Loan Requirements and the Application Process

- 4. SoFi Home Equity Loan Rates and Fees: A Detailed Look

- 5. Using the SoFi Home Equity Loan Calculator and Other Resources

- 6. Related articles 02:

- 7. Comparing SoFi Home Equity Loans to Alternatives for Home Improvements

- 8. Managing Your SoFi Home Equity Loan Effectively

- 9. SoFi Home Equity Loan Reviews and Community Discussion

- 10. Conclusion

Understanding SoFi Home Equity Loan Options for Home Renovations

When considering a SoFi home equity loan for your home improvement projects, it’s essential to understand the different options available and their respective advantages and disadvantages.

SoFi Home Equity Loan (Fixed-Rate)

A SoFi home equity loan provides a fixed-rate option, allowing borrowers to access a lump sum of money for their home improvement needs. This type of loan is particularly suitable for significant one-time projects, such as a kitchen remodel, where predictable monthly payments are a priority. The fixed interest rate ensures stability, meaning you won’t be affected by market fluctuations.

Pros of Fixed-Rate Loans:

- Predictable Payments: Borrowers can budget effectively with fixed monthly payments.

- Protection Against Rate Increases: Fixed rates safeguard against rising interest rates. For instance, a homeowner planning a 15-year kitchen renovation using a fixed-rate loan can accurately predict their monthly payments, simplifying their long-term budget. This contrasts sharply with a variable-rate HELOC, where fluctuating interest rates could lead to unexpected increases in monthly payments.

- Ideal for Large Projects: Suitable for one-time expenses that require a significant upfront investment.

Cons of Fixed-Rate Loans:

- Lump Sum Limitations: This structure may not be ideal for projects needing funds in phases.

- Higher Closing Costs: Compared to some alternatives, these loans may have increased upfront costs.

Before committing, it’s wise to explore current SoFi home equity loan rates and compare them with market averages to ensure you’re securing a competitive deal.

SoFi Home Equity Line of Credit (HELOC)

The SoFi Home Equity Line of Credit (HELOC) offers a flexible alternative, allowing homeowners to draw funds against their equity as needed. This flexibility is particularly advantageous for ongoing projects, such as a phased bathroom remodel, where expenses can be incurred over time.

Pros of HELOCs:

- Flexible Borrowing: Access funds as needed, paying interest only on the drawn amount.

- Ideal for Phased Projects: Perfect for renovations that occur in stages.

- Lower Initial Payments: Interest payments can be lower initially, easing cash flow.

Cons of HELOCs:

- Variable Interest Rates: Payments can fluctuate based on market conditions, making budgeting more complex.

- Payment Variability: Depending on how much is borrowed, monthly payments may change. However, a significant drawback of HELOCs is the potential for negative amortization. If the borrower draws heavily and interest rates climb, the principal balance could increase over time, resulting in a larger overall debt. This is especially concerning if the homeowner anticipates a period of lower income.

When considering HELOCs, it’s important to monitor the SoFi home equity loan rates associated with them, as these can vary significantly over time.

Cash-Out Refinancing

Cash-out refinancing is another effective way to leverage home equity. This option allows homeowners to refinance their existing mortgage for more than they owe and take the difference in cash. This can be particularly beneficial for those looking to consolidate debt or fund large renovations.

Pros of Cash-Out Refinancing:

- Potentially Lower Interest Rates: It may offer lower rates compared to your current mortgage.

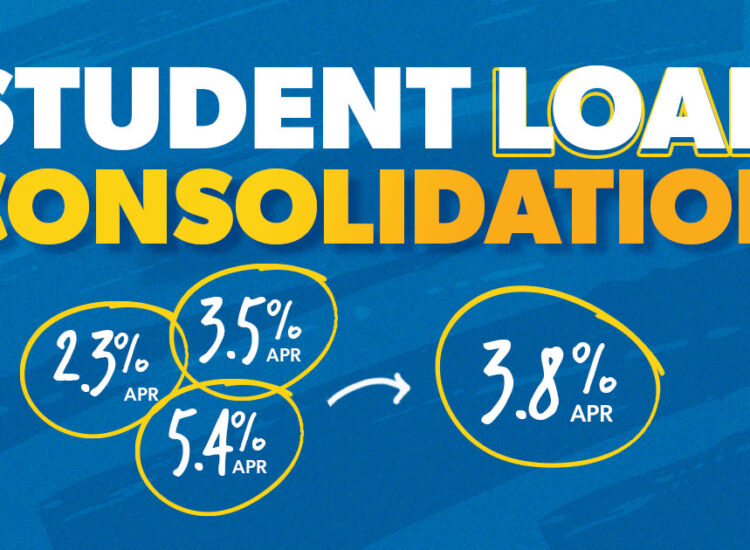

- Debt Consolidation: Combine multiple debts into one manageable payment.

Cons of Cash-Out Refinancing:

- Higher Closing Costs: These can be significant and should be factored into your decision.

- Extended Loan Terms: Refinancing can lead to longer repayment periods, increasing the total interest paid over time. While cash-out refinancing can offer lower interest rates, extending the loan term often increases the total interest paid over time and may lead to higher monthly payments. This can also impact the borrower’s debt-to-income ratio, potentially affecting their ability to secure other loans in the future.

Understanding the role of SoFi home equity loan lenders is crucial in navigating the cash-out refinancing process, as they will guide you through the requirements and terms.

2. https://sachico101.com/mmoga-what-is-a-good-student-loan-interest-rate-in-2024/

3. https://sachico101.com/mmoga-bank-statement-mortgage-loans-a-freelancers-guide-to-homeownership/

4. https://sachico101.com/mmoga-penfed-mortgage-loan-a-complete-guide-for-homebuyers/

5. https://sachico101.com/mmoga-bhg-loan-reviews-a-small-business-owners-guide/

SoFi Home Equity Loan Requirements and the Application Process

Before applying for a SoFi home equity loan, it’s essential to familiarize yourself with the eligibility criteria and the application steps involved.

Credit Score and Debt-to-Income Ratio

To secure approval for a SoFi home equity loan, a solid credit score and manageable debt-to-income (DTI) ratio are critical. SoFi typically requires a credit score of at least 680, though some lenders may accept lower scores under specific conditions. A lower DTI ratio, ideally below 43%, enhances your chances of qualifying.

Home Equity Percentage

Homeowners generally need to have at least 15-20% equity in their home to qualify for a SoFi home equity loan. This is assessed through the combined loan-to-value (CLTV) ratio, which should typically not exceed 90%. For example, if your home is valued at $400,000 and you owe $250,000, your equity is $150,000, resulting in a CLTV of 62.5%.

The Application Process

Applying for a SoFi home equity loan involves several steps:

- Gather Documentation: Collect necessary documents, including proof of income, tax returns, and details of your current mortgage.

- Home Appraisal: SoFi may require an appraisal to determine your home’s current market value.

- Review Terms: Carefully examine the loan terms provided by SoFi home equity loan lenders before proceeding. Before signing any documents, it is strongly recommended to compare loan offers from multiple lenders to secure the most favorable terms, including interest rates, fees, and repayment periods. This comparative shopping can lead to significant savings over the life of the loan.

- Closing: Upon approval, you’ll finalize the loan at closing, signing all necessary documents to receive your funds.

Using the SoFi Home Equity Loan Calculator

Utilizing a SoFi home equity loan calculator can help you estimate potential monthly payments and total interest. This tool allows borrowers to input various loan amounts, terms, and interest rates, providing a clearer understanding of their financial obligations.

SoFi Home Equity Loan Rates and Fees: A Detailed Look

Understanding SoFi home equity loan rates and associated fees is crucial for making an informed decision.

Factors Affecting Interest Rates

Several factors influence your interest rate, including your credit score, loan amount, loan term, and LTV ratio. Staying informed about current market rates can help you gauge what to expect.

Comparing SoFi Rates to Competitors

When assessing your options, it’s important to compare SoFi home equity loan rates with those from Upstart Holdings and other major lenders. Evaluating key factors such as interest rates, fees, and loan terms will help you find the best fit for your financial situation. While Upstart Holdings may offer competitive rates, their eligibility criteria may differ from SoFi’s.

Current Trends in Home Equity Lending

The Federal Reserve’s recent interest rate hikes have significantly impacted the home equity lending market, leading to increased borrowing costs for both fixed and variable-rate loans. This has made it crucial for borrowers to compare rates aggressively and consider the long-term implications of higher interest payments. Understanding these trends can help you make a more informed decision regarding your home equity loan options.

Fees and Closing Costs

Transparency regarding fees associated with a SoFi home equity loan is essential. Expect to encounter various costs, including origination fees, appraisal fees, and closing costs. Understanding these fees upfront can help you budget accordingly.

Using the SoFi Home Equity Loan Calculator and Other Resources

Using tools and resources effectively can simplify the process of obtaining a SoFi home equity loan.

SoFi Home Equity Loan Calculator

The SoFi home equity loan calculator is a valuable tool for estimating your monthly payments and total interest over the life of the loan. By inputting different loan amounts, terms, and interest rates, you can visualize your potential financial obligations.

Other Helpful Resources

In addition to the loan calculator, consider utilizing additional resources such as financial advisors, articles on home improvement budgeting, and websites that compare home equity loan options. These resources can provide insights and guidance as you navigate your financing options.

1. https://sachico101.com/mmoga-what-is-a-good-student-loan-interest-rate-in-2024/

2. https://sachico101.com/mmoga-bank-statement-mortgage-loans-a-freelancers-guide-to-homeownership/

3. https://sachico101.com/mmoga-bhg-loan-reviews-a-small-business-owners-guide/

4. https://sachico101.com/mmoga-penfed-mortgage-loan-a-complete-guide-for-homebuyers/

Comparing SoFi Home Equity Loans to Alternatives for Home Improvements

When exploring financing options for home improvements, comparing SoFi home equity loans with other alternatives is vital.

Personal Loans

Personal loans offer an alternative to home equity loans, especially for those hesitant to leverage their home as collateral. While personal loans may come with higher interest rates, they often involve a simpler application process and quicker access to funds. However, they may not provide the same borrowing capacity as a home equity loan.

Home Improvement Loans

Dedicated home improvement loans are another option for financing renovations. Typically unsecured, these loans are tailored specifically for home projects. Comparing interest rates and eligibility requirements with SoFi home equity loans can help you determine which option best meets your needs.

Other Lenders

It’s also beneficial to consider other lenders in the market. By examining their offerings and comparing them to SoFi’s, you can make a more informed decision about which lender aligns with your financial goals.

Managing Your SoFi Home Equity Loan Effectively

Once you’ve secured a SoFi home equity loan, understanding how to manage it effectively is crucial for maintaining your financial health.

Making Timely Payments

Timely payments are essential for preserving a good credit score and avoiding penalties. Late payments can lead to additional fees and negatively impact your creditworthiness. Setting up automatic payments can help ensure you never miss a due date.

Understanding Interest Rates (Fixed vs. Variable)

Understanding the differences between fixed and variable interest rates is vital. Fixed rates provide predictability, while variable rates may lead to fluctuations in your monthly payment amounts. Evaluate your financial situation to determine which option aligns best with your risk tolerance.

Tax Deductibility

Interest paid on home equity loans may be tax-deductible, especially if the funds are used for home improvements. It’s advisable to consult with a tax professional to understand the implications for your specific financial situation.

Monitoring Your Loan

Regularly reviewing your loan statements is essential for ensuring accuracy and identifying potential issues early. Keeping track of your balance and payment history will keep you informed about your progress and any upcoming payments due.

SoFi Home Equity Loan Reviews and Community Discussion

Exploring feedback from current and former borrowers can provide valuable insights into the SoFi home equity loan experience.

Analyzing Online Feedback

SoFi home equity loan reviews generally highlight the ease of the application process and competitive rates. However, some borrowers have expressed concerns regarding customer service and responsiveness. Balancing both positive and negative feedback will give you a holistic view of what to expect.

Community Insights

Platforms like Reddit often feature discussions about SoFi home equity loans, offering a community perspective. Engaging with these discussions can provide clarity on common issues and solutions experienced by borrowers.

Conclusion

In summary, a SoFi home equity loan offers homeowners an excellent opportunity to leverage their property’s value for various financial needs, particularly home improvements. Understanding the loan options, requirements, and management strategies is crucial for making informed decisions. As you explore SoFi’s offerings, consider comparing them with alternative financing options to ensure you choose the best fit for your financial goals. Take the time to evaluate your needs, consult with financial advisors, and reach out to SoFi for more information or to start the application process. With the right approach and preparation, you can effectively utilize a SoFi home equity loan to enhance your home and financial well-being.