Many believe quick loan approvals equate to favorable terms, but BHG loan reviews reveal a more nuanced reality. While some borrowers praise fast funding, others cite unexpectedly high interest rates and hidden fees. This article examines these conflicting accounts to help small business owners make informed decisions.

Toc

Understanding BHG Financial and Its Business Loan Products

Overview of BHG Financial

BHG Financial, founded in 2001, is a non-bank direct lender with a strong focus on healthcare professionals and small business owners. Initially known as Bankers Healthcare Group, the company has diversified its offerings to include personal and commercial financing solutions. Headquartered in Davie, Florida, BHG Financial has financed over $10 billion for more than 700,000 borrowers. With an A+ rating from the Better Business Bureau (BBB), the company establishes a level of trustworthiness that potential borrowers may find appealing. For inquiries, BHG Financial can be contacted directly via their office in Davie or through their customer service hotline.

Types of Business Loans Offered

BHG Financial provides a variety of business loan products tailored to meet the diverse needs of small business owners. Their offerings include:

- Business Opportunity Loans: Designed for entrepreneurs looking to invest in existing businesses or start new ventures.

- Existing Business Loans: Ideal for established businesses needing funds for daily operations or expansion projects.

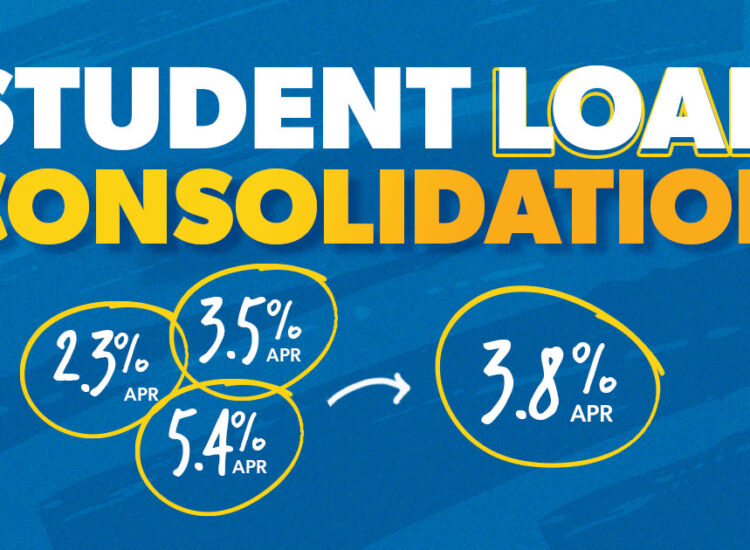

- Commercial Debt Consolidation: This option allows businesses to simplify their finances by merging multiple debts into a single payment.

- Medical Practice Loans: Specifically created for healthcare providers seeking financing for equipment or operational growth.

While BHG promotes maximum loan amounts of up to $500,000, most borrowers typically see loan amounts ranging from $20,000 to $250,000. It’s essential to be aware of these ranges when evaluating BHG loans.

Loan Terms and Interest Rates

The interest rates and terms for BHG loans vary based on several factors, including the borrower’s creditworthiness. Generally, interest rates begin at approximately 8.49% and can go up to 14.8%, with repayment periods extending up to 12 years. Small business owners must carefully compare BHG’s interest rates and terms to industry standards before making a decision, as these factors significantly impact the overall loan cost.

In-Depth Analysis of BHG Loan Reviews

Positive Reviews: Speed and Service

Many borrowers have shared positive experiences with BHG Financial, with common themes emerging in favorable reviews. Key highlights include:

- Fast Funding: Numerous customers commend the quick processing times, with some receiving funds within three business days. However, this speed often comes at a cost. A study by the National Federation of Independent Business (NFIB) in 2023 found that businesses prioritizing speed often accept higher interest rates. For example, a business needing funds urgently might accept a 12% interest rate from BHG for immediate access, whereas a more patient borrower might secure a 9% rate from a traditional bank after a longer application process.

- Helpful Customer Service: Positive feedback often emphasizes the professionalism and responsiveness of BHG’s loan specialists. Conversely, some borrowers have reported difficulty reaching representatives or experiencing delays in receiving responses to their inquiries. This duality in experiences highlights the importance of assessing customer service thoroughly.

- Competitive Rates: Several reviews indicate that borrowers found BHG’s interest rates reasonable, especially considering the flexibility and speed of funding offered. However, as discussed, these rates may still be above the market average for longer-term loans.

Platforms like Trustpilot and various online forums reflect these positive sentiments, suggesting that BHG Financial has made a strong impression on many small business owners.

Negative Reviews: Costs and Communication

On the flip side, not all feedback is positive. Negative reviews often highlight several recurring issues:

1. https://sachico101.com/mmoga-your-guide-to-sofi-home-equity-loans-for-home-improvements/

2. https://sachico101.com/mmoga-what-is-a-good-student-loan-interest-rate-in-2024/

3. https://sachico101.com/mmoga-penfed-mortgage-loan-a-complete-guide-for-homebuyers/

5. https://sachico101.com/mmoga-bank-statement-mortgage-loans-a-freelancers-guide-to-homeownership/

- High Interest Rates: Some borrowers feel that the interest rates were higher than initially expected, particularly compared to their understanding at the outset. The average interest rate for small business loans in Q3 2023, according to the Federal Reserve, was approximately 9.6%. This means that BHG’s rates, while potentially competitive for speed, might be above the market average for longer-term loans. Furthermore, some borrowers have reported difficulty understanding the APR (Annual Percentage Rate) calculation, leading to perceived discrepancies.

- Hidden Fees: Complaints frequently mention unexpected fees that were not clearly disclosed during the application process. This lack of transparency can lead to frustration and dissatisfaction among borrowers.

- Customer Service Issues: A segment of borrowers has reported challenges in communication and support when addressing concerns related to their loans. This inconsistency in service can significantly impact the overall borrowing experience.

These negative experiences can be found on platforms like Reddit and the BBB, where users express their frustrations regarding BHG Financial.

Addressing Concerns About BHG Financial Lawsuits

A noteworthy aspect to consider is the potential for legal issues surrounding BHG Financial. Past mentions of class-action lawsuits related to lending practices have raised concerns. It’s crucial for prospective borrowers to research these claims and understand the context. While some complaints exist, they don’t necessarily represent the experiences of all borrowers. Ongoing monitoring of BHG’s practices can provide further clarity.

Recent Industry Developments

The recent increase in interest rates by the Federal Reserve has impacted the lending landscape significantly. Many small business lenders, including BHG, have adjusted their rates accordingly. Additionally, the rise of fintech lenders offering alternative financing options, such as invoice financing and merchant cash advances, provides small business owners with more choices. This increased competition may pressure lenders like BHG to improve their offerings or risk losing market share.

BBB and Other Third-Party Ratings

When evaluating BHG loan reviews, it’s vital to consider their ratings on third-party platforms. BHG Financial holds an A+ rating from the BBB, indicating that they have taken steps to resolve customer complaints effectively. However, potential borrowers should look at the overall rating landscape, as discrepancies between positive and negative reviews across different platforms can be significant.

Pre-Application Steps

Before applying for a loan with BHG Financial, it’s essential to gather all the necessary documentation to ensure a smooth process. Business owners should prepare detailed financial statements, tax returns, and a clear, well-structured outline of how the funds will be utilized. This includes specifying whether the loan will be used for operational expenses, expansion, purchasing equipment, or other business needs. Having accurate and up-to-date financial information not only streamlines the application process but also minimizes the likelihood of delays or requests for additional documents. By being thoroughly prepared, applicants can present a strong case to secure the funding they need.

The Application Process

BHG Financial has designed a straightforward and user-friendly application process, making it accessible for both seasoned business owners and first-time borrowers. Applicants have the flexibility to apply online through their intuitive platform or via phone, depending on their preference. The online application interface is designed to be easy to navigate, guiding users through each step with clear instructions. Once the initial application is submitted, a dedicated loan representative will promptly reach out to the applicant. This representative acts as a guide, assisting with any questions and walking the borrower through the subsequent steps. Existing customers benefit from additional convenience by logging into the BHG Financial login portal, where they can access their loan details, track their application status, and connect with customer support. This personalized and supportive process ensures borrowers are never left in the dark.

Post-Application

After submission, BHG Financial carefully reviews the application to assess the borrower’s financial profile and loan eligibility. During this time, the company may request additional documentation, such as updated bank statements or proof of income, to finalize their evaluation. BHG Financial is known for its efficient process, with funding timelines as quick as three business days from approval. This speed can be a significant advantage for business owners who require immediate access to capital for urgent needs, such as covering payroll, purchasing inventory, or addressing unexpected expenses. Understanding the steps following the submission of the application can help borrowers manage their expectations and prepare for any next steps, ensuring the process remains smooth and transparent.

Managing Your BHG Loan and Potential Challenges

Understanding Your Loan Agreement

Before signing any loan agreement, it is critical for borrowers to thoroughly read and understand the terms and conditions. This includes reviewing the repayment structure, interest rates, fees, and any penalties for early repayment or late payments. Borrowers should also confirm the loan’s flexibility, such as options for payment adjustments or refinancing, should their financial circumstances change. Being fully informed about the agreement ensures that borrowers are aware of their obligations and can avoid future misunderstandings. If anything in the agreement is unclear, borrowers are encouraged to seek clarification from their loan representative or financial advisor.

Making Timely Payments

Maintaining timely loan payments is a key aspect of managing finances responsibly and preserving a good credit score. Late or missed payments can not only harm a borrower’s credit but also result in additional fees or penalties, compounding financial stress. BHG Financial provides tools and resources to help borrowers stay on track, such as automated payment options and reminders to ensure payments are never overlooked. By setting up these safeguards, borrowers can maintain their financial health and avoid unnecessary complications. Borrowers should also review their payment schedules regularly to ensure alignment with their cash flow, especially during periods of fluctuating business revenue.

1. https://sachico101.com/mmoga-what-is-a-good-student-loan-interest-rate-in-2024/

2. https://sachico101.com/mmoga-your-guide-to-sofi-home-equity-loans-for-home-improvements/

4. https://sachico101.com/mmoga-penfed-mortgage-loan-a-complete-guide-for-homebuyers/

5. https://sachico101.com/mmoga-bank-statement-mortgage-loans-a-freelancers-guide-to-homeownership/

Addressing Loan Difficulties

Financial hardships can happen to any borrower, and it’s important to know what options are available in such situations. Borrowers struggling to meet their repayment obligations should proactively reach out to BHG Financial’s customer service team for assistance. Depending on individual circumstances, options such as loan refinancing, restructuring payment schedules, or even debt consolidation may provide relief. Borrowers should also educate themselves on strategies for managing their loan, including understanding how to get out of a BHG loan if it becomes unmanageable. Early communication and seeking professional advice can help borrowers navigate challenges and find workable solutions without incurring further financial strain.

Customer Service Contact Information

For any questions, concerns, or support, BHG Financial’s customer service team is readily available to assist borrowers. Whether it’s inquiries about loan terms, payment options, or troubleshooting issues with the application process, representatives are trained to provide clear and helpful guidance. Borrowers can find customer service contact details on BHG Financial’s official website, including phone numbers, email addresses, and live chat options. For added convenience, existing customers can use the login portal to access support resources and manage their account directly. Reaching out to customer service ensures that borrowers have the support they need at every stage of their loan journey.

Exploring Alternatives to BHG Loans

While BHG Financial offers competitive rates and fast funding, it’s essential for borrowers to explore other options. Alternative lenders, credit unions, and traditional banks are all potential sources of financing that may offer more favorable terms. It can be helpful to compare different loan offers and ensure that the chosen lender aligns with the borrower’s needs.

Considering Other Lenders

While BHG Financial may present attractive options for many small business owners, exploring alternative lenders is also vital. Various online platforms and traditional banks offer different loan products that may better suit specific business needs. Researching these alternatives can lead to better financing options tailored to individual circumstances.

Benefits of Diversifying Lenders

Diversifying lenders can also provide protection against potential issues with one lender. By spreading out loan obligations, borrowers mitigate the risk of having all their funding tied to one institution. Additionally, different lenders may offer unique benefits or rewards programs that can benefit a borrower in the long run.

Conclusion

BHG Financial offers a range of business loan options that may benefit small business owners, particularly those in need of fast funding and flexible terms. However, weighing the advantages against potential drawbacks, including interest rates and service experiences reported by other borrowers, is crucial. As you consider your financing options, conducting thorough research and comparing BHG with other lenders will help ensure that you find the best fit for your business needs.

In summary, understanding BHG loan reviews, including insights from platforms like Reddit and the BBB, can provide valuable information to guide your decision-making process. Empower yourself by researching and comparing lenders before making a final choice.