The myth that freelancers are barred from homeownership due to inconsistent income is being challenged by bank statement mortgage loans, a financing option that allows lenders to assess financial health based on actual cash flow, not just tax returns. Many believe that homeownership is unattainable for freelancers, but this isn’t always true. Bank statement mortgage loans provide an avenue for freelancers to secure financing by focusing on their real income, offering them a chance at homeownership that traditional methods might deny. However, borrowers should be aware of the typically higher down payment and interest rates associated with this loan type. This guide will help you navigate the complexities of securing a bank statement mortgage loan.

Toc

- 1. Understanding Bank Statement Mortgages for Freelancers

- 2. Navigating the Challenges of Bank Statement Mortgages

- 3. Key Requirements for a Bank Statement Mortgage Loan

- 4. Related articles 01:

- 5. Finding the Best Bank Statement Mortgage Lenders

- 6. Navigating the Bank Statement Mortgage Application Process

- 7. Related articles 02:

- 8. Tips for Increasing Your Chances of Approval

- 9. Alternatives to Bank Statement Mortgages

- 10. Conclusion

Understanding Bank Statement Mortgages for Freelancers

A bank statement mortgage loan is tailored for self-employed individuals and freelancers who may not have traditional income verification through W-2s or tax returns. Instead of relying solely on these documents, lenders allow borrowers to use bank statements to demonstrate their income. This method provides a more accurate representation of a freelancer’s cash flow, which is often variable.

How Bank Statement Mortgages Work

When applying for a bank statement mortgage loan, lenders typically require 12 to 24 months of bank statements. They analyze these statements to calculate the average monthly income based on actual deposits. This approach is particularly advantageous for freelancers, as it focuses on cash flow rather than potentially misleading reported income. Some lenders even offer “3-month bank statement loans” for individuals with recent, stable income patterns, allowing for a quicker path to approval.

Advantages Over Traditional Mortgages

- Flexibility in Income Verification: Freelancers can effectively showcase their true income through deposits, making it easier to qualify for a loan.

- Accommodates Irregular Income: For those with fluctuating earnings, bank statement loans provide a more accessible option than conventional mortgages.

- Higher Debt-to-Income Ratios: Some lenders permit higher debt-to-income ratios, offering borrowers increased purchasing power.

While bank statement mortgage loans present a unique opportunity for freelancers, they also come with their own set of challenges.

Pros and Cons of Bank Statement Mortgage Loans

Advantages

- Flexibility: The ability to showcase actual income through bank deposits makes it easier for freelancers to qualify.

- Suitable for Irregular Income: These loans accommodate those with fluctuating earnings better than conventional options.

- Potentially Higher DTI Ratios: Some lenders allow higher debt-to-income ratios, giving borrowers more flexibility in their home purchase.

Disadvantages

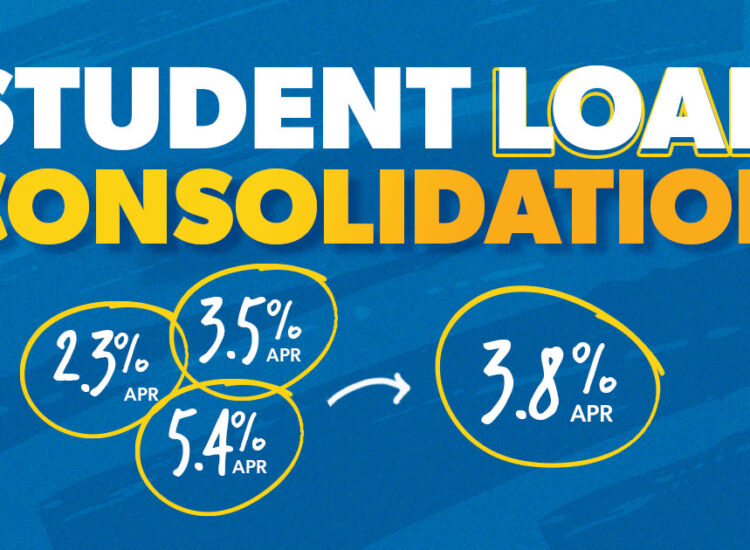

- Higher Interest Rates: Bank statement mortgage loans often come with higher interest rates compared to traditional mortgages, impacting long-term costs. While precise figures vary by lender and borrower profile, studies from organizations like the Consumer Financial Protection Bureau (CFPB) have shown that non-QM loans, which often include bank statement loans, can carry interest rates 0.5% to 2% higher than comparable prime loans. This difference can significantly impact the total cost of the mortgage over its lifespan. For example, a $300,000 loan with a 2% higher interest rate could result in tens of thousands of dollars more in interest paid over 30 years. However, some borrowers might find the flexibility and accessibility of bank statement loans outweigh the higher interest rate, particularly if they are unable to qualify for a traditional mortgage.

- Larger Down Payments: Borrowers may need to provide a larger down payment, typically ranging from 10% to 20%. While higher down payments are common, some lenders may offer programs with lower down payment requirements for borrowers with exceptional credit scores and strong cash reserves, demonstrating a reduced risk profile.

- Stricter Credit Requirements: While some lenders are lenient, a solid credit score is still essential for qualification.

Summary of Pros and Cons

Freelancers must weigh the benefits of flexibility and accessibility against the challenges of higher interest rates and down payment requirements. It’s crucial to maintain a good credit score, even when applying for a bank statement mortgage loan.

Key Requirements for a Bank Statement Mortgage Loan

Understanding the specific bank statement mortgage loan requirements is essential for freelancers looking to secure financing.

Income Verification Considerations

The process of income verification for bank statement mortgages involves a meticulous review of bank statements. Lenders often use sophisticated software to analyze deposit patterns, identify irregular income streams, and assess the overall financial health of the applicant. They look beyond simply averaging deposits; they consider factors such as the frequency and consistency of deposits, the sources of income, and any unusual transactions. This detailed analysis helps lenders mitigate risk associated with the inherent variability of freelance income.

Credit Score Considerations

A strong credit score is vital for obtaining a bank statement mortgage loan. Most lenders require a minimum score of 620, though higher scores can lead to better interest rates. Freelancers can improve their credit by paying down existing debts, ensuring timely payments, and correcting any inaccuracies in their credit reports.

Down Payment Expectations

Compared to conventional loans, down payments for bank statement mortgage loans tend to be higher. While some lenders may offer options as low as a bank statement loan 5% down, most will expect at least 10-20%. It’s advisable to save for a larger down payment to improve loan terms and reduce monthly payments.

Cash Reserves Requirement

Many lenders require borrowers to have cash reserves equivalent to several months’ worth of mortgage payments. This ensures lenders that borrowers can meet their obligations even during months of lower income. Freelancers should aim to build these reserves by saving a portion of their income regularly.

1. https://sachico101.com/mmoga-what-is-a-good-student-loan-interest-rate-in-2024/

2. https://sachico101.com/mmoga-bhg-loan-reviews-a-small-business-owners-guide/

4. https://sachico101.com/mmoga-penfed-mortgage-loan-a-complete-guide-for-homebuyers/

5. https://sachico101.com/mmoga-your-guide-to-sofi-home-equity-loans-for-home-improvements/

Duration of Bank Statements

Lenders typically request 12 to 24 months of bank statements. However, options for “3-month bank statement loans” may be available for those with recent, consistent income. Always check with lenders for specific requirements, as they can vary.

Debt-to-Income Ratio

Maintaining a manageable debt-to-income (DTI) ratio is critical. Lenders generally look for a DTI ratio of 43% or lower, but some may allow up to 50%. Freelancers can improve their DTI by reducing debts or increasing their income.

Additional Documentation

In addition to bank statements, freelancers may need to provide other documentation, such as proof of self-employment, identification, and explanations for any unusual deposits. Keeping organized financial records will streamline this process.

Finding the Best Bank Statement Mortgage Lenders

Choosing the right lender is crucial for securing a bank statement mortgage loan.

Reputable Lenders to Consider

Several lenders specialize in bank statement loans, offering various terms and conditions. It’s advisable to research and compare lenders based on their interest rates, fees, and customer service.

- Best Bank Statement Mortgage Lenders: Look for lenders known for their expertise in non-QM loans, especially those catering to self-employed individuals. Seek lenders that provide flexible documentation requirements and competitive rates.

Comparing Lender Options

When comparing lenders, consider using a bank statement loan calculator to estimate potential monthly payments based on different loan amounts and interest rates. This tool can help freelancers evaluate their options effectively.

Avoiding Predatory Lenders

Be cautious of lenders who may engage in predatory practices. Look for transparent terms, competitive rates, and positive customer reviews. Trust is paramount when choosing a lender, as the mortgage process can be complex.

The application process for a bank statement mortgage loan can appear daunting, but understanding the steps can simplify it.

Pre-qualification Steps

Before formally applying, it’s wise to get pre-qualified. This process involves a preliminary assessment of your financial situation and helps you understand how much you can borrow.

Document Collection

Gather all necessary documents, including bank statements, proof of self-employment, and any additional documentation required by your lender. Having these ready will expedite the application process.

Submitting Your Application

Once you have everything prepared, submit your loan application. Be ready for potential follow-up questions or requests for additional documentation.

Understanding Underwriting

The underwriting process involves a thorough review of your financial situation. Lenders will assess your income, creditworthiness, and overall risk. This stage is crucial, as it determines whether your loan will be approved.

After Loan Approval

If approved, you’ll receive a loan commitment outlining the terms and conditions. Review these carefully before proceeding to closing.

Closing the Loan

The closing process involves signing final documents and transferring ownership. Understanding what to expect during closing will help make the process smoother.

1. https://sachico101.com/mmoga-your-guide-to-sofi-home-equity-loans-for-home-improvements/

3. https://sachico101.com/mmoga-what-is-a-good-student-loan-interest-rate-in-2024/

4. https://sachico101.com/mmoga-bhg-loan-reviews-a-small-business-owners-guide/

5. https://sachico101.com/mmoga-penfed-mortgage-loan-a-complete-guide-for-homebuyers/

Tips for Increasing Your Chances of Approval

Securing a bank statement mortgage loan can be competitive, so implementing strategies can enhance your chances of approval.

Maintain Consistent Deposits

Regular and consistent deposits in your bank account will demonstrate financial stability to lenders. Freelancers should aim to deposit income as soon as it is received.

Separate Business and Personal Finances

Keeping personal and business finances separate simplifies the loan process and provides clearer insights into your income. This separation is critical when applying for a bank statement mortgage loan.

Improving Your Credit Score

Work on enhancing your credit score before applying. Pay bills on time, reduce debt, and consider consulting a financial advisor if necessary.

Building Cash Reserves

Freelancers should focus on saving to create a cash reserve that meets lender requirements. Consider setting up automatic transfers to a savings account to build these reserves over time.

Reducing Debt Levels

Lowering your debt will improve your DTI ratio, making you a more attractive candidate for a mortgage. Prioritize paying down high-interest debts first.

Preparing Thorough Documentation

Ensure all documentation is complete and organized before submitting your application. This preparation can speed up the underwriting process and increase your chances of approval.

Staying Updated on Loan Rates

Interest rates can fluctuate, so it’s wise to stay informed about bank statement loan rates today. Regularly checking rates allows you to make informed decisions about the timing of your loan application.

Alternatives to Bank Statement Mortgages

If a bank statement mortgage loan isn’t the right fit for you, several alternatives exist.

FHA Loans

FHA loans are backed by the Federal Housing Administration and are designed for individuals with lower credit scores or smaller down payments. These loans can be a viable option for freelancers who may not qualify for conventional mortgages.

Conventional Loans with Alternative Documentation

Some lenders offer conventional loans with alternative documentation options for self-employed individuals. These loans can provide the benefits of traditional financing while accommodating unique income situations.

Asset Depletion Loans

For freelancers with significant assets but lower income, asset depletion loans can be an option. These loans allow borrowers to qualify based on their assets rather than income.

Conclusion

Navigating the world of bank statement mortgage loans can be complex, but understanding the requirements and process can make it more manageable. Freelancers and gig economy workers can find a pathway to homeownership through these loans by showcasing their true income through bank statements. By diligently managing their finances, meticulously documenting their income, and seeking professional guidance, freelancers can unlock the door to homeownership through bank statement mortgages. Always consider consulting a mortgage professional for personalized advice tailored to your financial situation.